Employer Sponsored Health Plans — Doing Away with Copays and Deductibles in 2021

It’s likely that you have employees who have skipped medication refills or visits to their provider because of high out-of-pocket costs.

Unfortunately, this happens far too often. One RAND study concluded that higher copays were associated with lower rates of drug treatment, worse adherence among existing users, and more frequent discontinuation of therapy. As out-of-pocket costs like copays and deductibles continue to rise, Americans are increasingly skipping out on needed care, and we all end up paying more for the health crises that come as a result.

So why are cost-sharing measures like copays and deductibles a part of health plans? And when did paying for healthcare and medications become so complicated? The answer has a lot to do with profits, and little to do with consumers. (But the good news is, there are alternatives to explore.)

A little history on cost-sharing

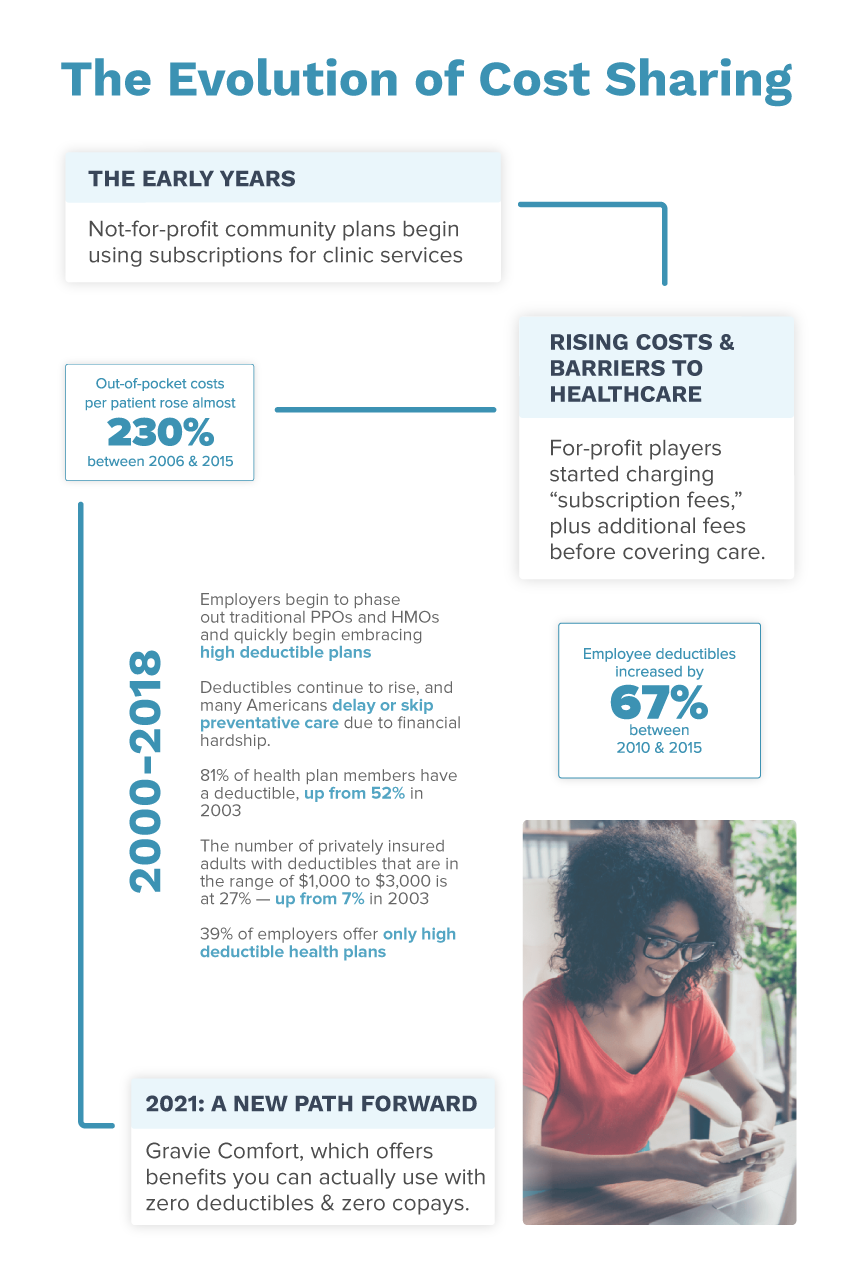

Copays and deductibles, part of a collective concept known as cost-sharing, originally came about during the Great Depression. Not-for-profit community plans set monthly “subscription fees” so that families could still get the care they needed during trying times.

As the popularity of these plans grew, for-profit players wanted in on the action. They started out charging the not-for-profit “subscription fees” but soon began placing more financial requirements on members that had to be paid before any care would be covered. And that’s when the modern deductible and copay were born.

Cost-sharing today

Today, deductibles can be more than $13,000 per year for a family and more than $6,000 for an individual. The result is Americans must essentially determine how much money they are willing to bet against themselves – that they won’t get sick or have a major accident and have to use their insurance.

Cost-sharing measures – originally intended to prevent patients from breaking the bank on medical care – now prevent many individuals from seeking care at all.

How did we get here? And what type of plan allows us to actually use our health benefits to pursue what they were intended for – preventative care and wellness?

A better way forward: plans that prioritize prevention and wellness

Here’s some good news: Your employees’ health and wellbeing no longer need to be hindered by the ever-rising costs of copays and deductibles. There’s a new plan available that removes these barriers while helping you control, and even reduce, costs.

Gravie Comfort is the nation’s first-of-its kind health plan that has eliminated copays and deductibles, offering 100% coverage on common healthcare services, including primary care, urgent care, specialist visits, online care, labs and imaging, generic prescriptions, and more.

By removing the fear of surprise bills and hidden costs, as well as deterrents like deductibles and copays, Gravie Comfort gives employees the freedom to fully pursue their health. By incentivizing care early and often, you can create a workplace culture that encourages addressing health concerns before they become an emergency and a greater detriment to our lives, not to mention our personal and collective bank accounts.

It’s time to stop letting copays and deductibles get in the way of your employees’ health. Health insurance plans were initially designed to make healthcare more accessible. A zero copay and zero deductible plan like Gravie Comfort does what it should – it makes our workforce healthier.

Gravie Comfort is available for employers and their employees for the 2021 plan year. To learn more, visit www.gravie.com/gravie-comfort/.