How to Make the Case for Defined Contribution Employee Benefits

In previous posts we’ve reviewed the employer “squeeze play” and other factors that make it tougher and more confusing to provide health benefits to employees. If you’re feeling like you’ve looked at all your options and none seem great, you’re not alone.

More and more employers have found a better alternative. They’re tapping into the “defined contribution” approach (as opposed to “defined benefit”) as a great fit for them. It helps them avoid penalties, provide a benefits experience their employees love, and set a predictable, controlled budget. (For more details about how Gravie amplifies the positive aspects of defined contribution, see how it works.)

For many, the financial advantages are significant – the average saving for our current employer customers is 36% compared to their previous group health plan – but even if the savings aren’t that dramatic, eliminating the hassle of a traditional group/defined benefit approach makes total sense.

To help employers see how the Gravie approach to defined contribution works for their organization, we created a detailed, free, and custom report called the Gravie Dynamic Financial Analysis. This tool is also helpful for employers that are looking to build a business case for their defined contribution strategy.

Gravie Dynamic Financial Analysis: Your Customized Case for Defined Contribution

The analysis report includes three sections using an employer’s roster and policy data to summarize defined contribution alternatives to their current state. The inputs you provide result in a view of how defined contribution plays out for your organization and employees. Here’s what’s in your custom report:

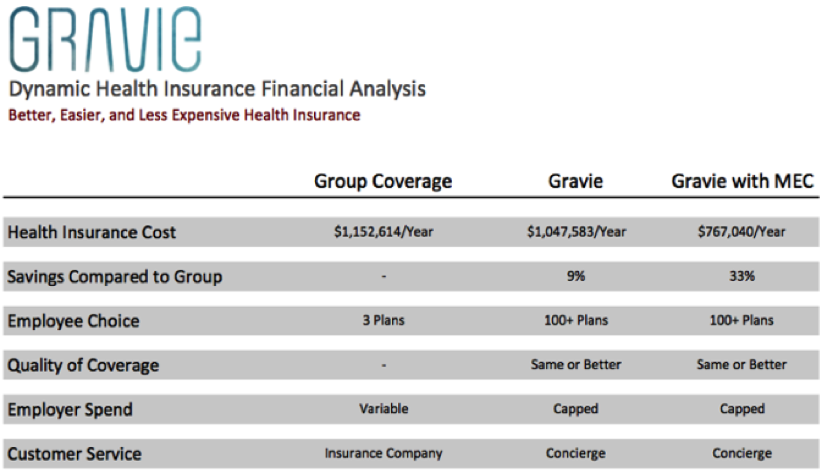

SECTION 1: SUMMARY

This section compares, in plain language, the most important puzzle pieces as you consider a change to Gravie. As shown in the image below, this includes the following elements for your group plan versus Gravie:

- Health Insurance Costs for the Employer

- Savings Compared to Group

- Employee Choice

- Quality of Coverage

- Service and Cost Model

What does it mean?

In this example the employer will save 33% if they move to Gravie and a Minimum Essential Coverage (MEC) plan. Keep in mind that a change to Gravie’s defined contribution model also makes costs more predictable for employers (you set your budget) while giving employees better plan choices and go-to advisors for all their questions.

(Wondering what a MEC plan is? It’s a group plan that offers what the Affordable Care Act deems the lowest amount of coverage that’s still compliant with the ACA. It’s also a plan that our employers with 50 or more employees offer alongside Gravie to reduce or eliminate the penalties they’re subject to under the Employer Shared Responsibility rules.)

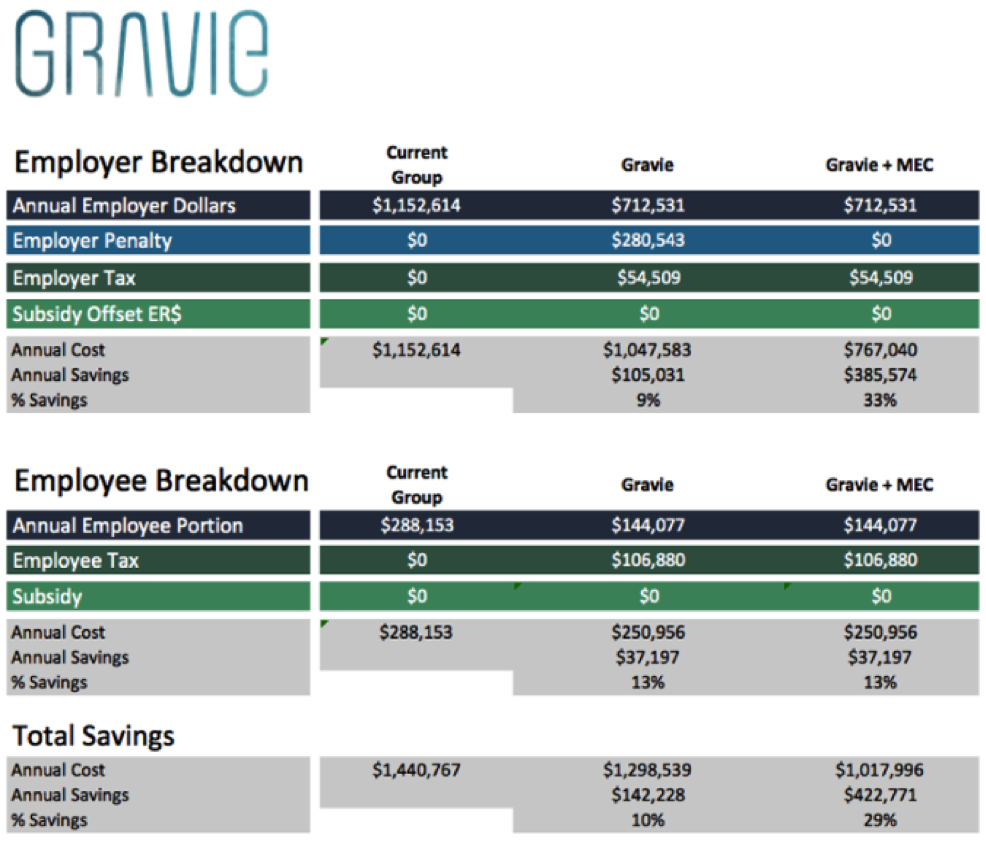

SECTION 2: TOTAL COST IMPACT FOR EMPLOYERS AND EMPLOYEES

This section outlines the cost differences for employers and employees. It then summarizes the changes. In this example, notice that there are lower costs for the employer and the employee:

What does it mean?

This summary puts the data for employees and their employer on the table to see if the transition to the individual market makes financial sense for both sides. This means that the employer can have confidence that employees will be better off and can use this data to communicate why the change makes sense.

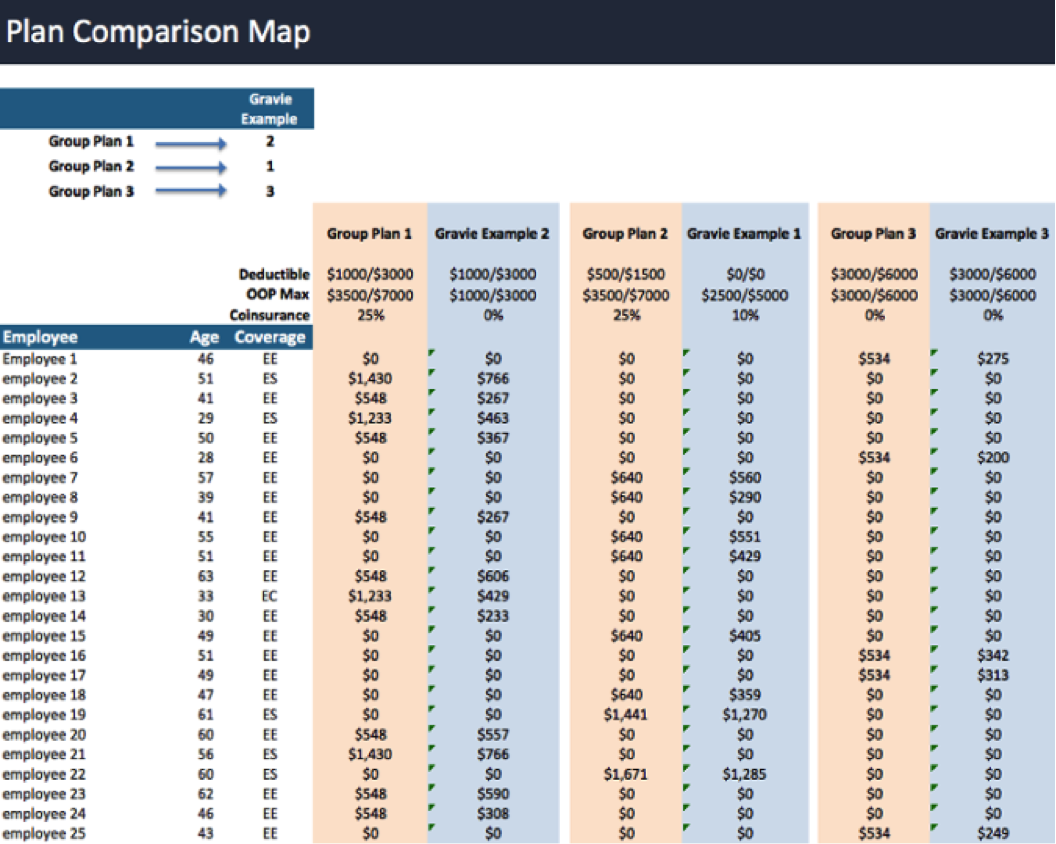

SECTION 3: PLAN COMPARISON MAP

This section provides a simple way to evaluate how your current group plan compares to a few real plan options available in the individual market. (Keep in mind your employees can choose from hundreds of options, not just the ones shown in the comparison.) With the plan option examples, you can see how each of your employees are impacted. As you review your options, this provides another lens to analyze what’s best.

What does it mean?

In this example every employee is either no worse off or in some cases far better off cost-wise with the shift to the individual market and Gravie. (In other words, a similar plan to the one they currently have will cost them less.) It’s also important to note that since employees now have much more choice, they can work with a Gravie advisor to find a plan that’s even better for their specific situation—whether that means it’s a plan with a higher deductible and lower monthly cost or vice versa. Employees often end up with a better plan for them.

ADDITIONAL ANALYSIS: IN-DEPTH VIEW OF TAXES, EMPLOYER PENALTIES, AND GOVERNMENT TAX CREDITS

The additional visibility you get with a deeper look at taxes, penalties, and government tax credits can provide another layer of confidence in the data. This report truly is an open book, so we’ll walk through each item in detail to make sure it all makes sense. Employers have seen tremendous value in the overview sections and the more detailed views help finance leaders dig into the numbers even deeper.

GET YOUR GRAVIE FINANCIAL ANALYSIS

If you’re looking into a defined contribution approach to employee benefits, contact us today to learn what Gravie could mean for your organization’s finances and your employees’ satisfaction.

We look forward to hearing from you!

Register here for our free webinar: Welcome to Your Future – Employer’s Guide to Modern Employee Benefits on Wednesday, June 8, 12pm CDT.