Today’s Multi-Generational Workforce & Employee Benefits

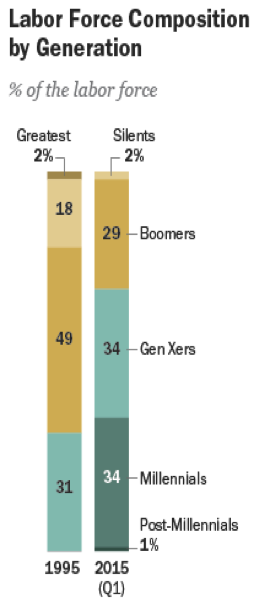

In 2017, people are living and working longer. As a result, we’re facing a new future in terms of demographics at work. In the past, we’ve had three to four generations in the workplace as once, but now we have five. And in addition to adding a fifth generation to the mix, the differences in work behaviors and preferences has never been greater.

Among the many challenges this new, multi-generational workforce brings, employee benefits are at the top of the list. Not only do these different generations have unique needs when it comes to health care, they also have different needs for health insurance and benefits. (See: Are Your Employees Parked in a Group Health Plan Wasteland?)

Employers struggle to provide benefits that satisfy their diverse workforce, but there are alternatives that can help employers get relief from the common burdens of health plans and still provide benefits employees love. Let’s take a look at how the three largest generations stack up in terms of their benefits needs and how a reinvented approach can help keep them happy and healthy:

Baby Boomers

- Baby boomers are the generation most satisfied with their current health care experience.

- They are of an age group that accesses medical care more often than other generations in the workplace.

- According to a study by the Pew Research Center in 2015, they make up about 29% of the workforce.

- Some members of this generation qualify for Medicare.

- Although this generation is tech savvy, they prefer connecting with a person when they have questions or concerns regarding their health benefits.

Generation X

- This generation has had more work-life balance and was much more open to flexible benefits.

- They have branched out from traditional programs but are still accustomed to how things have been done.

- Compared to other generations, this group has more dependents on average.

- According to a study by the Pew Research Center in 2015, they make up about 34% of the workforce.

- Falling between the baby boomers and millennials, this generation is more ‘flexible’ than other generations.

- This generation is tech savvy. They are open to getting benefits help by connecting with a real live person or online.

Millennials

This group has been much more benefit savvy and willing to make decisions.

This group has been much more benefit savvy and willing to make decisions.- Many have high student debt and prefer unique options available through employers/market platforms.

- According to a study by the Pew Research Center in 2015, they make up about 34% of the workforce. In 2020, they are expected to surpass Generation X as the largest generation in the workforce.

- They are not opposed to paying for high-tech and high-touch healthcare experiences, such as an on-camera visit with a doctor or an app that enables a consultation with specialists.

- This generation is very tech savvy. They prefer to shop and get help with their benefits online via email, chat or a shopping platform.

How Gravie’s model makes benefits better for all:

- With the defined contribution approach, employers can vary the amount of money they offer employees to purchase benefits. If they wanted, an employer could offer older employees or employees with families more money to put towards benefits.

- Employees of all ages have unique needs. This is why Gravie offers choice. With Gravie, employees get to choose their own benefits that work best for them and employers aren’t stuck trying to pick a health plan that meets the needs of their 60-year-old employees as well as their 25-year-old employees. (For more on this, check out our post on playing to the average.)

- As of February 2017, Medicare eligible employees can purchase Medicare plans through Gravie. This means that as employees transition through life stages, they’ll have the options they need at any given time.

- Employees that qualify for inexpensive catastrophic plans can purchase them through Gravie.

- Employees get Gravie Care, which includes unlimited access to expert licensed advisors that help with anything benefits related.

- Your employees can access Gravie Care and/or get help shopping for benefits and purchasing benefits in whatever way is best for them – in person, over the phone, or by using our online shopping platform.

While the multi-generational workforce of today poses challenges to employers, it’s also an exciting time. In addition to different work behaviors and preferences, these generations add value bringing a unique blend of skills, experience and knowledge to the workplace.

When employers partner with Gravie to provide benefits, they can rest assured that their employees, regardless of age, will have access to competitive benefits, as well as expert guidance and support from the Gravie advisors.

If you’re an employer interested in getting started with Gravie, contact us today.

Graphic: Pew Research Center tabulations of monthly 1995 and 2015 Current Population Surveys, Integrated Public Use Microdata Series

National Institute on Aging

This group has been much more benefit savvy and willing to make decisions.

This group has been much more benefit savvy and willing to make decisions.