Redefining Preventative Care to Control Costs and Maintain a Healthy Workforce

As employers consider what aspects of their health benefits and wellness programs will be investments towards a healthier workforce, one important thing to consider is how your health plan covers preventative care. Experts agree: Getting needed preventative care in a timely fashion can ultimately reduce overall medical expenses. Screening and testing for diseases or injuries on a regular basis makes them potentially easier to address sooner than when they become a more pervasive problem. The CDC estimates that preventative services lowers economic output in the U.S. by $260 billion a year.

It’s important that employees take advantage of these services – to maintain wellbeing, reduce absenteeism and keep them performing at their best. In the end, the economics make sense for all: the insurance provider, the employer subsidizing the plan and the employee.

Incentivizing preventative care

However, until now, preventative care has mostly been limited to one check-up per year. But while individuals understand preventative care to include one annual check-up, there isn’t incentive to take care of other issues when they arise. Often, individuals and families are left weighing the risks of getting the care they need with the costs involved. Financial prudence for many families sounds like, “let’s wait and see if it’s still a problem tomorrow, and then we can call a doctor.”

But if we take care of problems only when absolutely necessary, they may become more harmful, and in turn, more expensive to care for in the long run. In our current climate, individuals don’t perceive their health benefits to truly cover what they need, and therefore aren’t accessing medical services as frequently as they should to keep themselves healthy, and in turn, costs low — making the investment worth it for the employer, too.

So how do we continue to incentivize individuals to get the care they need when they need it – shifting beyond an annual check-up to regular screens, tests and treatments, and providing more compelling and competitive benefits that employees will find value in? How do we redefine or expand our understanding of what’s preventative?

One way is through education – helping individuals understand the investments to their health now and how they will pay off down the road. In a real sense, all healthcare is on a spectrum of preventative care and the more issues we treat early and often before they trail further down on the emergency spectrum, the healthier our workforce will be and the better off we’ll all be from a healthcare spending standpoint.

Another way: Completely restructuring health insurance plans to incentivize individuals to getting the care they need.

Rather than hoping people a) can afford to invest in the care they need and b) consider it worthwhile, we can restructure health plans to expand the idea of preventative care and incent engagement on the earlier on. It’s an idea that the CDC has encouraged, estimating that if everyone in the country received recommended clinical care, then the healthcare system could save over 100,000 lives a year. They understand that expanding, lowering or eliminating cost sharing (e.g. deductibles, coinsurance or copays) and offering a broader range of preventative services can help reduce costs and save lives.

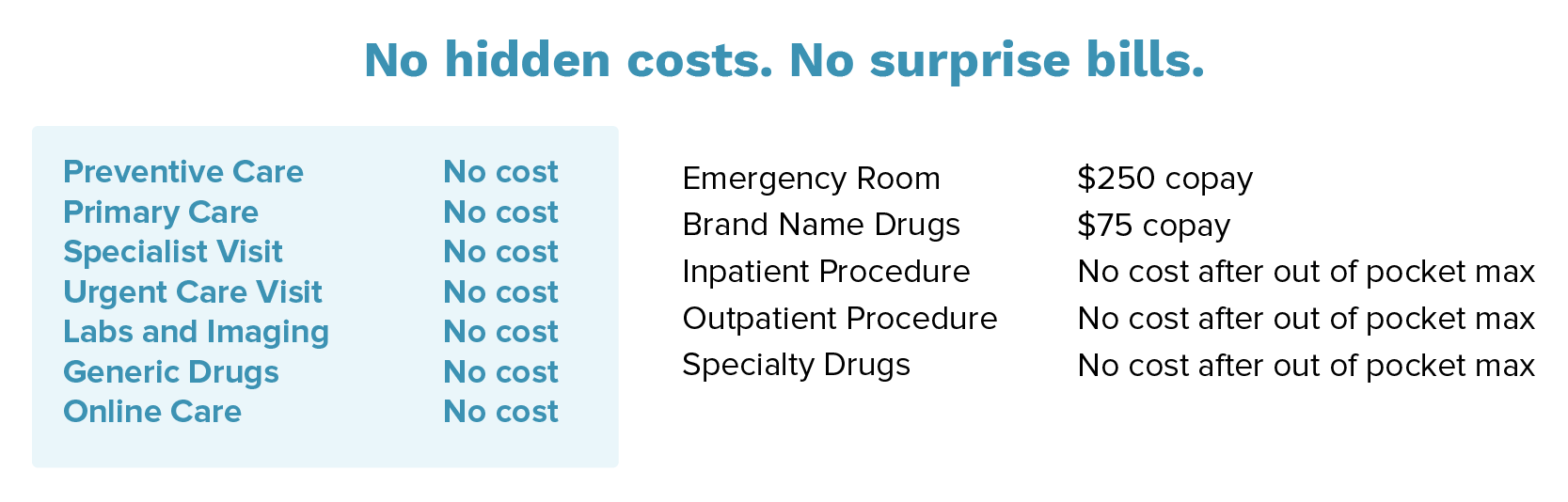

Gravie is doing just that, and providing an innovative approach to benefits with Gravie Comfort. Gravie Comfort provides 100% coverage on common healthcare services, including generic prescriptions, at a cost comparable to most traditional group health plans. This means zero cost sharing and zero hidden costs or surprise bills.

With Gravie Comfort, employers get peace of mind that their employees have health benefits they can actually use, and employees get comfort knowing they can get the care they need when they need it. In an industry where consumer satisfaction is painstakingly low for both employers and employees, and prices are increasingly rising, Gravie Comfort provides a fresh approach at a cost comparable to most traditional group benefits. As employers and employees consider what healthcare investments will pay off in the biggest way – from the standpoint of health outcomes and financial control – the way forward must prioritize getting individuals the care they need, exactly when they need it, and stay as far left on the preventative side of the spectrum as possible.

Want to learn more? Visit www.gravie.com/gravie-comfort/.