2026 ICHRA forecast: A long-term benefits solution for small and midsize businesses

Individual Coverage Health Reimbursement Arrangements (ICHRAs) experienced gangbuster growth in 2025. According to the HRA Council, ICHRAs grew 34% among large employers and 52% among other employer types. It’s no wonder that Congress has started paying attention to ICHRAs for the first time in several years. Unfortunately, legislative provisions that would have codified ICHRAs into law and expanded tax incentives for businesses offering them failed to become law. This setback, along with anticipated increases in individual market rates attributed to prescription drug costs, the impact of tariffs, and cuts to Medicaid, among other things, have some employers wondering if ICHRAs make sense for them in 2026.

It’s a fair question, but when considering all of the factors it’s clear that ICHRAs remain the best approach to better employer health benefits for many employers.

First, it’s important to keep in mind that, historically, the trend in the individual market has consistently grown at a much smaller rate than that in the group market. In fact, according to Urban Institute, the average national growth trend for individual plans has been less than 2% between 2019-2025 while the group trend has been more than 5% for the same period of time.

Second, carriers have more price control levers to pull in the individual market than in the small group category. “Relative to group coverage, the individual market is structurally advantaged from a medical cost control standpoint,” according to Shyam Vichare, Partner at Oliver Wyman. “The individual market offers wider choice to consumers, which along with subsidy dynamics means marketplace plans face much greater price competition. This leads to purpose built networks, provider reimbursement rates, referral requirements and care management programs all designed to control cost.”

Third, let’s remember that, as the largest risk pool in America, rates in the individual market are far more stable than their group counterparts, where the slightest change in one’s health can dramatically affect rates for the entire group. Moreover, decisions about health benefits should be made with a long-term view in mind, rather than as a one-year rate game.

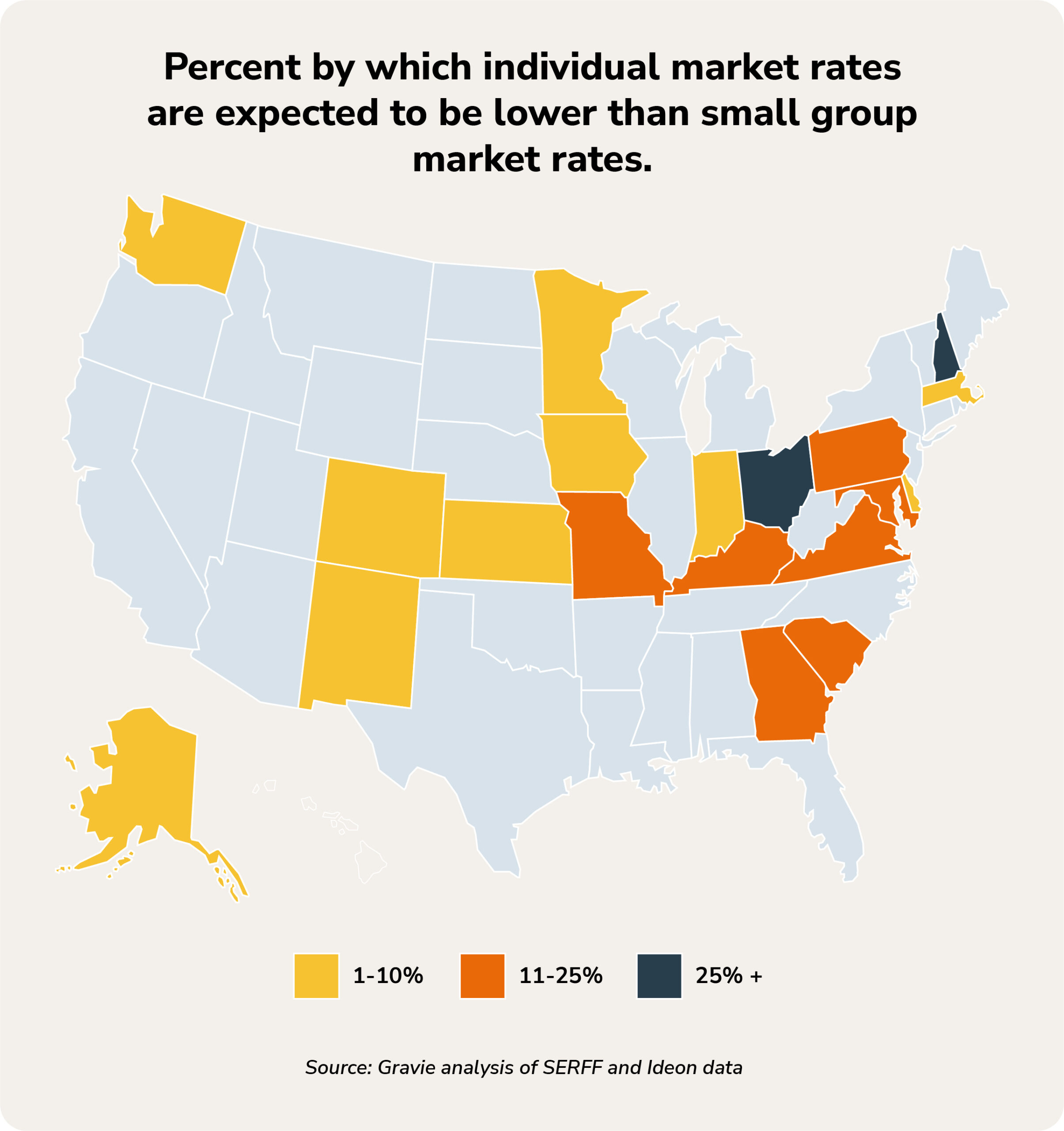

Lastly, our recent analysis of 2026 proposed individual and group market rates at the state level reveals that group coverage rates will remain higher than individual market rates in many states.

It’s crucial to note that even these state averages are just directional. An individual employer’s actual premium will be heavily influenced by their specific employee census and their contribution strategy. Indeed the delta between individual and group rates will likely narrow in 2026, but overall ICHRA will still be the clear path into the future.

As brokers and employers consider ICHRAs, it’s worth noting that rates alone are not the only consideration when choosing a group’s health plan. ICHRAs reduce employer risk and enable companies to ensure predictable costs, while giving employees the freedom to select benefits that fit their unique needs. That is an invaluable equation that doesn’t exist elsewhere in the health benefits landscape.

It’s understandable that rising individual rates in some states might give consultants pause when considering ICHRAs. But the ICHRA train has left the station with no sign of slowing down. The long-term opportunity is too significant for employers and employees alike to sit back and observe. Those who take action now to pioneer ICHRAs will ultimately reap the most rewards.